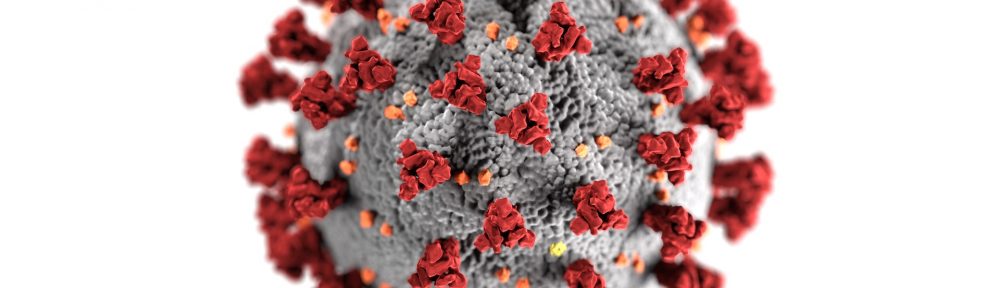

The COVID-19 pandemic has upended many aspects of our lives, from the way we work and socialize to the way we plan for the future. Unfortunately, the pandemic has also led to a spike in deaths, leaving many families to cope with the loss of loved ones.

In some cases, individuals who have passed away from COVID-19 may not have had a Last Will and Testament in place. A Last Will and Testament is a legal document that outlines a person’s wishes for the distribution of their assets and the care of their dependents after their death.

When someone dies without a Will, their estate will go through a legal process known as probate. Probate is the process of administering the estate of a deceased person, which involves validating the Will, paying off any outstanding debts or taxes, and distributing the remaining assets to the heirs.

In the case of COVID-19, where the illness can strike suddenly and without warning, it is important for individuals to plan ahead and have a Will in place. A Will allows people to have control over how their assets will be distributed, and it can help ease the burden on their loved ones during an already difficult time.

Imagine losing both of your parents and THEN have to deal with the lack of a Last Will and Testament. What advice would you give to someone in that situation. Click on the link below to find out what advice is given to someone in that EXACT scenario: What now?

Even during a pandemic, it is important to plan for the future and take control of one’s estate